how long does the irs have to collect back payroll taxes

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

By law the IRS only has ten years to collect the unpaid taxes from the time of the initial tax assessment.

. After this 10-year period or statute of limitations has expired the IRS can no. Possibly Settle Taxes up to 95 Less. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Get Your Qualification Options for Free. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date. How far back can the IRS collect unpaid taxes.

How long can the IRS collect back taxes. This 10-year period is called the statute of limitations on collections. If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4.

If you file your return 2019 return late say Jan 1 2022 then the IRS has until JAN 1. If you file early lets say January 31 2020 the IRS has until April 15 2030 to collect. As a general rule according to the statute of limitations they can collect up to 10 years from the date your taxes were assessed.

This time restriction is most commonly known as the statute of limitations. This means the IRS should. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

If you dont pay on time. Time Limits on the IRS Collection Process. If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date.

There is an IRS statute of limitations on collecting taxes. Ad File Settle Back Taxes. Take Advantage of Fresh Start Program.

The same rule applies to a right to claim tax. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. The IRS has a set collection period of 10.

As a general rule there is a ten year statute of limitations on IRS collections. If the IRS shows up after that you may be able to say the statute of limitations has run. The IRS takes failure to pay payroll taxes especially with respect to active businesses very seriously and often assigns field agents to stop businesses that accrue payroll tax liability over.

Trusted A BBB Member. After that the debt is wiped clean from its books and the IRS. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

The IRS doesnt have forever to collect taxes from you. Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes. You Wont Get Old Refunds.

As a general rule there is a ten year statute of limitations on IRS collections. After this 10-year period or statute of. Understanding collection actions 4 Collection actions in.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. In most cases the IRS has three years to audit you after you file your return.

Irs Can Audit For Three Years Six Or Forever Here S How To Tell

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

How To Find Out How Much You Owe In Irs Back Taxes Turbotax Tax Tips Videos

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

What Does The Irs Do And How Can It Be Improved Tax Policy Center

How Long Do Federal And State Tax Returns Need To Be Kept Turbotax Tax Tips Videos

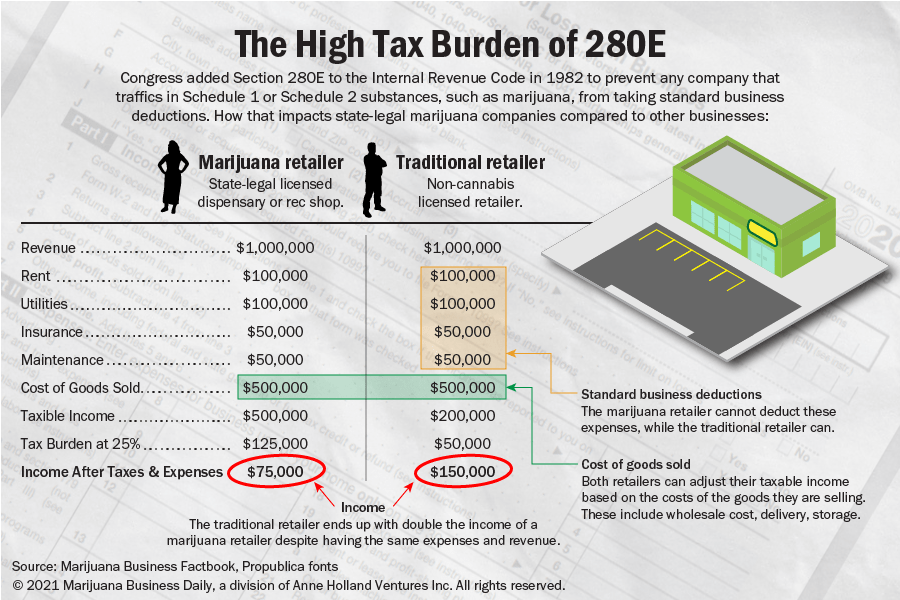

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Help My Business Owes Back Payroll Taxes To The Irs

Help My Business Owes Back Payroll Taxes To The Irs

Employer Payroll Taxes What They Are And How They Work Adp

What To Do If You Owe The Irs And Can T Pay

Can The Irs Take Or Hold My Refund Yes H R Block

Irs Rules On Trump S Payroll Tax Cut Put Firms On The Hook For Taxes

Are There Statute Of Limitations For Irs Collections Brotman Law

Irs Delays Start Of Tax Filing Season To Feb 12